One hundred years ago, in 1924, the Austrian economist Ludwig von Mises issued a revised German-language edition of his 1912 book Theorie des Geldes und der Unlaufsmittel. Ninety years ago, in 1934, there appeared an English-language edition under the title The Theory of Money and Credit. Over the more than a century since Mises’s book first appeared, the political and institutional circumstances of much of the world have gone through dramatic changes, yet the theoretical and policy analyses and insights of The Theory of Money and Credit have withstood the test of time.

When the first edition was published, the major countries of the world, including Mises’s Austro-Hungarian homeland, had monetary systems based on the gold standard. In 1912, two years before the beginning of the First World War, many Europeans and North Americans were still living in the afterglow of the classical-liberal epoch of the nineteenth century. Governments were still relatively limited in size and scope. Taxes were fairly low, with accompanying modest levels of government spending. Those same governments, in general, mostly respected a wide array of civil liberties and personal freedoms. Freedom of trade and enterprise was the normative standard, even if some of those governments, especially in Imperial Germany, had reintroduced various protectionist barriers and were intervening in a variety of domestic economic activities. Yet, at the same time, the far-flung British Empire was administered as a global free-trade zone welcoming buyers and sellers and investors with few if any limits based on their nationality.

The monetary system before and after World War I

The central banks of these European countries (the United States did not have a comparable national central bank in the form of the Federal Reserve System until 1914) all generally followed the “rules” of the gold standard. Bank notes and bank deposits were viewed and treated as “money substitutes,” that is, claims to the “real” money of gold and silver. Discretionary monetary manipulations by central banking authorities were generally frowned upon and not excessively practiced. If prices in general significantly rose for a period of time, it was usually due to significant increases in the world supply of gold, not the result of politically motivated paper-money inflations. However, the rationales and calls for “activist” monetary policies were increasingly for purposes of “social policy.”

When the revised second German edition of The Theory of Money and Credit appeared in 1924, the world was a radically different place from what it had been in 1912. Many of those major countries had gone through the four years of the First World War (1914–1918), and some had politically disintegrated, with the German, Russian, and Austro-Hungarian empires disappearing from the map of Europe. The prewar liberal institutions and beliefs concerning personal and economic freedom had been weakened, if not shattered. Gold redemption for paper currencies had ended among the belligerent nations in 1914 so their governments could, respectively, resort to the monetary printing presses to cover their huge war expenses.

In the immediate postwar years of the early 1920s, destructive hyperinflations were experienced in places like Germany, Austria, and Russia. Half-hearted attempts were made to restore gold-based currencies that were mere shadows of the prewar monetary system. In addition, dictatorships had come to power in the form of Marx-inspired communism in Russia under Lenin and the Bolsheviks and in the form of fascism in Italy under the leadership of Mussolini (who coined the term “totalitarianism” to express his conception of the role and power of the state). An assortment of authoritarian regimes came to power in a number of other countries.

Ten years later, in 1934, when the English-language edition of The Theory of Money and Credit was published in Great Britain, the world had changed even more. The major industrial countries were in the throes of the Great Depression following the stock market crash of October 1929, with worst of the rising unemployment and falling production experienced in the United States and Germany, though the severity of the depression was not much less felt in Great Britain and France and many other places. The gold standard had been abandoned, either de jure or de facto, virtually everywhere, with paper monies in their place as government policy tools to try to “fight” the depression.

Also, in 1933, Hitler and the Nazi Party had come to power in Germany, with dictatorial control rapidly imposed on all facets of German life and society. In the United States, Franklin Roosevelt had become president and soon imposed his own version of a fascist-like economic system on the United States in the form of New Deal centralized economic planning (which partially came to an end through a series of Supreme Court decisions in 1935 and 1936 that declared some New Deal programs to be unconstitutional).

Economic principles and the theory of money

In the preface to the 1934 English edition, Mises said that the monetary and banking institutional circumstances certainly had changed from the times when the first and second editions of his book had appeared in 1912 and 1924, respectively. But he argued:

Ten years have elapsed since the second German edition of the present book was published. During this time the external apparatus of the currency and banking problems of the world has completely altered…. [But] amid this flux, the theoretical apparatus which enables us to deal with these questions remains unaltered. In fact, the value of economics lies in its enabling us to recognize the true significance of problems, divested of their accidental trimmings. No very deep knowledge of economics is usually needed for grasping the immediate effects of a [policy] measure; but the task of economics is to foretell the remoter effects; and so to allow us to avoid such acts as attempt to remedy some present ill by sowing the seeds of a much greater ill in the future.

Economists had been intensely analyzing monetary and banking theory and policy issues since at least the middle of the eighteenth century. Some of them were among the most famous economists of their time, including David Hume, Adam Smith, David Ricardo, John Stuart Mill, and others like Jean-Baptiste Say, Henry Thornton, Nassau Senior, and John E. Cairnes, to name just a few of the prominent ones.

But virtually all of them built their ideas on the “classical” labor theory of value, that is, that the value of any good — including a commodity such as gold or silver — ultimately derived its long-run value in the marketplace based on its costs of production, reducible to a quantity of labor time and effort that had gone into the extraction of resources and the manufacture of the finished good.

After the emergence of the subjective theory of value, especially with the publication of Carl Menger’s Principles of Economics (1871) and its elaboration by his “Austrian” followers, Friedrich von Wieser and Eugen von Böhm-Bawerk in the 1880s and 1890s, the labor theory of value was replaced by the theory of (marginal) subjective value. Ultimately, the value of any good was derived from its “utility” or usefulness in satisfying a human want or desire. The “utility” of any particular unit of a specific quantity of a good was based on the wants it satisfied in descending order of importance.

The means of production (land, resources, labor, capital) received their value from their “indirect” usefulness in enabling a desired finished good to be manufactured into the final form that resulted in the desired consumption satisfaction. In turn, the marginal value of any specific unit of such means of production was derived from the value of the marginal unit of the final good produced relative to its utility to being used in some alternative line of production.

Menger had explained the origin of money as a medium of exchange in his Principles of Economics (1871) and in his Investigations into the Methods of the Social Sciences (1883). He demonstrated that money was not a creature or a creation of the State; it emerged “spontaneously” over a long period of time as people attempted to overcome the difficulties of direct barter exchange. In his famous monograph on “Money” (1892), Menger extended his analysis to trying to analyze the demand to hold money based on its marginal valuation in acts of exchange.

The origin of money and its value through time

But it really was not until Mises’s Theory of Money and Credit that there was an especially thorough and satisfying exposition of the demand for money and its purchasing power, or value, in the marketplace. Mises adopted Menger’s theory of the origin of money: individuals in search of opportunities for gains from trade may discover that while Sam has what Bill wants, Bill does not possess what Sam would take in trade to give up what is in his possession. Even if there is what economists have come to call a double coincidence of wants (each has what the other desires in a trade), the characteristics of the goods in question may preclude their division into relative amounts reflecting a set of agreed upon terms of trade without one or both of these goods losing their desired qualities (for example, dividing a horse in half ends its usefulness for riding or pulling a wagon).

Over time, individuals discover that some goods are more valuable in terms of the fairly wide demand for them or their relative ease of divisibility without losing their desired qualities, or their convenience in being transported to where trades may occur, or the durability of their qualities and useful characteristics over time. Historically, those goods that have demonstrated the greatest combinations of such attributes have tended to be more frequently utilized as a media of exchange, until only one or two have become the ones most widely used for money.

Money, increasingly, therefore, is on one side of every exchange. People trade the good they possess for a sum of the money, and then turn around and use that money to purchase all the other goods they desire from all the other individuals participating in the expanding social system of division of labor. As a result, again over time, the good used as money derives its market value from two sources: from its original usefulness as some good used for consumption or production and its now additional usefulness as a medium of exchange. As time passes, its usefulness and value for as a medium of exchange may overshadow and perhaps finally completely supersede its usefulness and value as a consumption or production good.

Then its primary or even singular value is simply as a market-chosen means of exchange. Its continued use is now based on its social institutionalization as money and people’s estimates of its value in market transactions based upon its observed value for exchange purposes. The link in following money’s value backwards would be traceable to the day when that good was first also used as money, the day before which it simply was considered useful and valuable as a consumption or production good. While money’s historicity explains how and why it had a value for exchange purposes in the past, its value is determined by people’s subjective (marginal) valuations concerning its anticipated usefulness and value in the exchange opportunities today and in the future. Mises’s analysis of the value of money through and back in time became known as the Regression Theorem.

The meaning of the value of money and economic calculation

Another particular quality of the money-good in the marketplace is that unlike other goods bought and sold, money has no single price. With money on one side of every exchange, all traded goods and services tend to have one price, their respective money price. That is, how many units of money to buy or sell a hat, or purchase a house, or pay for a particular meal in a restaurant. Money becomes the unit of account, with the relative values of all goods expressed in the single common denominator of their respective money prices. This makes possible and facilitates the ease of “economic calculation,” the valuation and appraisement of the relative values of individual goods and combination of goods for purposes of determining “more expensive” and “less expensive,” and of profit or loss.

However, due to money’s unique place in the nexus of exchange, money has as many prices as goods against which it trades. This is precisely because money remains as the only good that directly trades for everything else offered on the market. Money may be thought of as the hub of a wheel of exchange, with each of the spokes being the individual goods against which money is being traded, with all the spokes connected by the same unit of exchange. If we then ask, what is the value, or general purchasing power, of money, the answer is the array, or set, or network of relative prices between money and all the other goods against which it is trading at any moment in time.

Mises was critical of the now common attempts to “measure” the value of money through the construction of price indices, such as the Consumer Price Index (CPI). Every such index involves creating a selected “basket” of goods considered representative of the purchasing habits of some “average” household or buying unit to which are assigned “weights” to the various goods in the basket (that is, the relative amounts of each purchased on a regular basis), and which is then tracked to determine the cost of buying that “basket” over a given period of time. If the cost of the basket has increased (decreased) over that period, it is said that the value of the monetary unit has decreased (increased) by a certain percentage and that the society has experienced price inflation (price deflation) to that degree over that time period.

Understanding the reason for Mises’s critical view of index-number methods for trying to measure changes in the value or purchasing power of money gets us to a crucial and central aspect of his whole

theory of how monetary changes

influence the market process. The focus on a single price index number for an averaged and summarized set of individual goods and their prices in that “basket” easily creates the impression that changes in the purchasing power of money occur uniformly and seemingly simultaneously.

Mises was an adherent of what is generally referred to as the quantity theory of money. That is, all other things held the same, any general rise or fall in the value or purchasing power of money has its basis in either a change in the total quantity of money in the economy or in a change in people’s willingness to hold a certain average monetary cash balance to facilitate their desired transactions over a period of time (often referred to as money’s “velocity,” that is, the number of times a given quantity of money “turns over” to facilitate a given number of transactions over a period of time).

Mises argued that if prices, in fact, increased (decreased) simultaneously and proportionally, that is, at the same time and by the same percentage, monetary changes would have no or few “real” effects on the relative price, wage, production, and output relationships in the market. For instance, suppose the price of a pair of shoes was $10 and the price of a hat was $20; then their relative price relationship would be two pairs of shoes traded for one hat in the marketplace. If now a 10 percent increase in the quantity of money resulted in a proportional rise the price of shoes to $11 and the price of a hat to $22, the relative price relationship between shoes and hats would still be two pairs of shoes for one hat, even though in absolute terms the price of both was now higher. Monetary changes would be “neutral” in their effects on the “real” relationships between prices and goods in the marketplace.

The nonneutrality of monetary changes

However, this was and is not the way changes in the quantity of money impact and influence prices or the relative supplies of goods in the market process, Mises insisted. Money, instead, was “nonneutral” in its effects. Mises, of course, was not the first economist to point this out. Richard Cantillon (1680–1734) drew attention to it in his Essay on the Nature of Commerce in General (1755), as did David Hume (1711–1776) in his famous essay “Of Money” (1752). An especially detailed analysis of money’s nonneutral effects was given by John E. Cairnes (1823–1875) in his essays on the impact of the Australian gold discoveries in the 1840s on global prices over time in his Essays in Political Economy (1873).

But Mises made the nonneutrality of money a centerpiece of his analysis in The Theory of Money and Credit and in his later expositions in Monetary Stabilization and Cyclical Policy (1928) and in Human Action, A Treatise on Economics (1949). There is no such thing as “helicopter money” that falls from the sky and reaches the pockets of each member of the society at the same time and in the same amount. New or additional quantities of money are introduced or “injected” into the market at some particular point(s) as additional cash holdings now available, first, to some individuals before others.

Suppose there is an increase in the gold supply, as Cairnes analyzed in the case of the Australian gold discoveries. The newly mined gold appeared first in the pockets of the prospectors who brought that gold to the coastal towns of Australia. It was used to increase the demand for the variety of particular goods and services these miners wished to buy, with the prices of these goods rising first in the face of an increased monetary demand for them.

To meet the new demand, a portion of the newly discovered gold was exported to Great Britain and other European countries in exchange for increased supplies of manufactured goods now wanted in those Australian towns, with European prices rising, in turn, in a particular sequence. To expand production for those export goods and the greater consumer demands of the European exporters who now had the financial wherewithal to increase their own demands for desired goods, some of the additional gold in the hands of Europeans was exported to other parts of the world in exchange for greater supplies of resources and raw materials in an attempt to increase the supply of manufactured goods. Resource and raw material and goods prices began to rise in a certain sequence in other parts of the world to meet the new demand.

Slowly but surely, the gold discoveries in Australia affected global prices, first in the Australian coastal areas, then in various parts of Europe, followed by rising prices in other corners of the world. Many, if not all, prices were eventually impacted throughout the world, Cairnes argued, but in a particular temporal sequence reflecting who had the new supplies of gold first, second, and third and the patterned effect this had on relative prices, wages, profits, and productions. The final effect of this process was a generally higher “level” of prices in the world economy, but this had come about neither simultaneously nor proportionally.

If one follows the “microeconomics” of the “macroeconomic” effect of changes in the quantity of money, there is no way that prices in general can be rising other than through the sequential process by which new quantities of money are introduced into the hands and demands of one group of people, then another group of people, followed by another and another. It is only then that through the rising demands for first some goods, then other goods, and, then, still other goods that, cumulatively, prices in general will have gone up in some uneven and sequential pattern.

The monetary injection points and their nonneutral impact

Mises emphasized that there is no rigid and mechanical process about all this because it all depends upon the historical and institutional circumstances of how the change in the quantity of money is introduced. The sequence outlined above with an increase in gold supplies “injected” into the global economy via, at first, the spending patterns of Australian gold miners, will be different from a fiat-money system in which paper currency is printed and used by a government to cover, say, war expenses.

As Mises explained, in this alternative scenario, the new money enters the economy as a greater government demand for military armaments and accompanying war material. The demands for and the prices of war manufactures will tend to rise first. Their profit margins increase at the start, followed by the wages and resource prices of the factors of production they increase to satisfy the government’s greater demands for the means needed for war. The higher relative revenues and incomes of those working in and drawn into war-related productions in the economy now increase their money demands for other desired goods, bringing about rises in another set of prices and demands for the things they wish to buy. And so on, until, again, prices in general in the economy may now be higher, but it will have been brought about in its own particular nonneutral temporal sequence of rising prices and wages and changes in the relative productions of various goods and services.

Another element in this non-neutral monetary process, Mises argued, was an inescapable modification and redistribution of income and wealth. The very fact that some demands and prices and wages rise before others necessarily improves the real relative income positions of some in the society and reduces the real relative incomes of others. Those who experience higher prices and wages for their goods and services earlier in this temporal sequence have higher money incomes to spend before many of the prices of the goods they want to demand have increased in price. Hence, they have more money to spend for goods whose prices have not yet increased or not by as much as their own. This represents a real increase in income for as long as the prices they receive from the goods and services they sell continue to rise more and before the prices the goods and services they buy.

Others in society do not do as well. Given the temporal sequence in which the demands and prices of various goods are rising during the monetary expansion, those individuals and groups who experience higher and rising prices for the goods and services they regularly buy before the prices and wages for the goods and services they sell rise equally or more experience a decline in their real relative incomes. These latter members of society lose during the monetary inflationary process, while those in the earlier groups and sectors of the economy gain from the on-going inflation. Those on fixed incomes or pensions are, clearly, the most obvious victims of monetary inflations.

Monetary deflations are equally nonneutral in their effects

Mises was equally clear that monetary contractions, or “deflationary” processes, were just as nonneutral in their effects on prices, wages, profits, and incomes. As he explained in The Theory of Money and Credit:

Monetary appreciation [falling prices], like monetary depreciation [rising prices] does not occur suddenly and uniformly throughout a whole community, but as a rule starts from single classes and spreads gradually…. The first of those who have to content themselves with lower prices than before for the commodities they sell, while they still have to pay the older higher prices for the commodities they buy, are those who are injured by the increase in the value of money. Those, however, who are the last to have to reduce the prices of the commodities they sell and have meanwhile been able to take advantage of the fall in prices of other things, are those who profit from the change.

This is why Mises considered it futile and counterproductive to try to compensate for the effects of a prior monetary inflation by following it by a monetary deflation. The deflation merely brings in its wake its own nonneutral effects different from and in no way compensating for the loses that particular individuals may have suffered during the monetary inflation. Or as Mises expressed it in a later essay on “The Non-Neutrality of Money” (1938):

[Some] suggest methods to undo changes in the purchasing power of money; if there has been an inflation they wish to deflate to the same extent and vice versa. They do not realize that by this procedure they do not undo the social consequences of the first change, but simply add to it the social consequences of a new change. If a man has been hurt by being run over by an automobile, it is no remedy to let the car go back over him in the opposite direction.

Mises emphasized, as we saw, that how monetary expansions (or contractions) work their way through the marketplace depends on the particular institutional and historical circumstances in which the monetary change occurs. But, in fact, the monetary and banking institutional setting when Mises published and revised The Theory of Money and Credit and wrote his later expositions, as in Human Action, remained fairly much the same, and remains so today. That is, monetary and credit expansions occur through banking systems overseen and fundamentally controlled by central banks.

Given this institutional arrangement of modern monetary and banking systems, Mises applied his theory of the nonneutrality of money to understand and analyze the processes through which inflations and recessions, the booms and busts of the business cycle, are brought about. And, furthermore, what institutional changes would have to be introduced if the causes and consequences of the business cycle were to be eliminated or at least greatly reduced.

***

When the second German-language edition of Ludwig von Mises’s The Theory of Money and Credit appeared 100 years ago, in 1924, it was less than a year since the great German and Austrian inflations had come to an end in 1923. (See my article “The Great German and Austrian Inflations, 100 Years Ago,” Future of Freedom, March 2023.) The huge monetary expansions had pushed prices in general to astronomical heights, bringing social and economic havoc in their wake. It had these effects precisely because of the inherent and inescapable “non-neutral” manner in which increases in the money supply are “injected” and introduced into society.

During the war years, the monetary expansions had been primarily used to feed the fiscal needs of the imperial German and Austrian governments to finance their military expenditures. In the postwar period between 1918 and 1923, the monetary printing presses had been set loose to cover the interventionist and welfare statist policies and programs of the new “democratic” governments in the German “Weimar” Republic and the much smaller Republic of Austria. The unevenness with which prices rose, with some prices rising before others, in both systematic and unsystematic patterns, distorted the structures of relative prices and wages, bringing about the appearances of profits in some sectors of the German and Austrian economies and losses in others that influenced the attempted uses of resources, labor, and capital.

One aspect of this monetary inflationary process was what became known as “forced savings,” the rising of selling prices before input prices, especially wages, which resulted in the real incomes of many workers falling relative to profit margins of investors and capital owners. It was called forced savings due to it leading to attempts for greater capital investment than would have seemed possible and profitable in a noninflationary environment. This twisted process was highlighted due to the exaggerated nature of it under a hyperinflation, when prices were rising at hundreds of percent per month. The noted Italian economist Constantino Bresciani-Turroni, the author of The Economics of Inflation (1931), pointed out:

Inflation, and more especially “hyperinflation,” may be compared with a magnifying glass, which has allowed of distinctly observing many of the facts not easy to disentangle when following the sequence of events during an ordinary Trade Cycle. The changes in the structure of production, brought about by inflation, and later by a currency stabilization [in 1924], were most apparent in Germany. During the inflation period the substantial fall in real wages, which meant a ‘forced savings’ on a large scale, allowed the productive resources of the country to be deflected from the production of consumer goods to that of fixed capital. This continued as long as the new issues of paper money exerted a pressure upon real wages.

But when the German inflation came to an end in November 1923, there set in a “stabilization crisis” in which the German economy went through a reversal, with capital values falling relative to consumer goods prices, and a rebalancing of labor and capital uses and prices to reflect the new noninflationary setting. Bresciani-Turroni concluded, “It seems to me that these facts are significant” as an “inductive verification” of the Austrian theory of inflationary processes.

Another aspect of money’s non-neutrality, matching forced savings, was that of “capital consumption,” already emphasized by Mises in his earlier book, Nation, State, and Economy (1919), before the worst of the German and Austrian inflations had occurred. With selling prices often running ahead of input prices (including money wages) for a period of time, the inflation created the impression of increased profit margins that acted as the incentives to undertake capital investments and expand output levels. However, when private enterprises reentered resource markets to continue production processes anew, they often found that input prices now had (with a lag) risen more than the higher input prices they had previously earned; as a result, these recently earned sales revenues were sometimes not sufficient to purchase all of the needed inputs to continue output at the same and higher levels, with often the inability to replace capital that had been used up in production processes.

Hence, capital was “consumed,” bringing about declines in the productive capacities of the economy as a whole. All the inflationary “good times” turned out to be a great illusion with disastrous effects from a more longer-term perspective. Or as Mises expressed it in The Theory of Money and Credit, “Inflation had the great advantage of evoking the appearance of economic prosperity and of increased wealth, of falsifying calculations made in terms of money, and so concealing the consumption of capital.”

Money and choices in the present vs. the future

The other important aspect to Mises’s analysis of money and the monetary system, therefore, was the role of a medium of exchange in the relationship between savings and investment. All economic decision-making revolves around the problem of how best to use the means at our disposal to attain the desired ends. Many of these decisions involve us choosing between a variety of alternatives. Shall I use some of my available means to buy a hat today or a new shirt? Shall I order ham and eggs for breakfast at a local restaurant or pancakes with maple syrup? Shall I read the morning newspaper for the next half hour or watch my favorite 30-minute sitcom on my streaming service?

But other decisions involve us making choices between alternatives over and across time. Having graduated from high school, do I enter the job market right away and start earning a full-time income to buy many of the things I would like to have in the here-and-now? Or do I forego all or part of that earnable income for the next four years to go to college and finish with a degree that puts me on a career track that will result in my very likely earning far more income in the future than if I take a job right out of high school? Do I spend all or most of my earned income now, or do I put some of it aside to start accumulating a nest egg for retirement, or into savings in case of an unexpected emergency, or to have most or all of the tuition ready to pay for my child’s future college education?

These and many similar types of choices concern options nearer to the present or further into the future. These are time preference decisions and choices between alternatives. Indeed, our decisions about the purposes for which we will use some of our available means in the present always include the implicit choice of deferring some consumption desires today for some gain in the future (when that future could be minutes, hours, days, or years away from right now). And like all other choices, time preference decisions are also made “at the margin,” that is, a little bit less of something in the present in order to have a bit more of something desired in the future.

Time preference, gains from trade, and the rate of interest

Sometimes, individuals find themselves with differing time preferences. One person has less means at his disposal for some project that he would like to undertake over time, the desired outcome of which would not be until some point in the future. Another individual, however, might be willing to defer using some of his available means today for a desired end if there is a financial incentive to wait to use them until sometime in the future.

In the old Popeye-the-Sailor cartoons, Wimpy would say, “I will gladly pay you Tuesday for a hamburger today.” But the person asked to wait until Tuesday to be paid by Wimpy for that hamburger might reasonably reply, “Why should I forgo eating that hamburger myself today, or not selling it to someone else willing to pay for it right now?” Then Wimpy would have to ask himself how much more might he be willing to pay in the future for today’s hamburger, and how much the owner of that hamburger would want to be paid in the future to forgo his own consumption, or the premium over today’s hamburger price, to make it worth his while for him to wait until the future to be paid. That premium in the future over the item’s current value or price is the basis of a market rate of interest.

The rate of interest, in other words, as the Austrian economists argued almost from the origin of the Austrian school, is the price of future goods over present goods. Of course, in the developed market economy, goods in the present do not directly trade for goods in the future. As in all market transactions, the exchange is facilitated through the medium of money to overcome the difficulties and “impossibilities” of barter, due to a lack of a coincidence of wants or indivisibilities in the goods to be bought and sold, or because goods offered in the present are not necessarily the same goods to be received in the future.

The saver who consumes less than the full income he has earned lends to the borrower an agreed amount of money. The saver forgoes his demand for particular goods in the present that he might otherwise have spent his money in purchasing, and for which particular resources would have been used to meet that demand. Instead, that sum of money passes into the hands of the borrower for the period of the loan, and he demands other types of goods than the lender would have. Resources, labor, and capital (tools, equipment, machinery) are devoted to different uses over that period of time, the outcome of which will be a finished good or product of some sort that the borrower anticipates will meet a future demand and earn a profit that more than justifies the expenses incurred and the interest payments to be made to the lender. When the loan is repaid, the lender may roll over that sum of money to lend it again to earn additional interest income, or spend all or part of the original principal and interest income on some of the present demands he wishes to satisfy.

Maintaining and increasing capital through savings

Imagine that there is a baker who possesses an oven that enables him to bake one thousand loaves of bread each day. No matter how diligent the baker may be in repairing and maintaining his oven, at some point wear and tear will require it to be replaced.

There needs to be enough savings by some in the society for sufficient resources, labor, and certain other types of capital to be “freed up” from current consumption so that others on the production side of the market may have them available to manufacture the new replacement oven in a market-coordinated manner such that the new oven will be available for sale and installation when the old oven needs to be replaced. Only in that manner could a given level of production of a thousand loaves of bread per day be ensured.

We can also imagine that the time preferences of some members of the society change, such that they save more; that is, they demand fewer consumer goods today and therefore free up more resources for investment purposes. By some consuming less and saving more, the greater supply of savings on the loan market would tend to competitively lower the rate of interest. Since the lower rate of interest has, other things held the same, lowered the costs of producing ovens, the oven manufacturer could borrow the additional savings to now produce, say, two ovens. He could then offer the two to the baker at a lower price that makes it sufficiently attractive for the baker to purchase both the replacement oven and a second oven to expand his daily output of bread.

If the technology of the ovens has not changed, then the baker, with two ovens, could now supply two thousand loaves of bread every day on the market at a lower per unit price, bringing about a general rise in the standard of living with more food available for consumption. Thus, the “sacrifice” of some consumption satisfactions in the past due to greater savings is “rewarded” with more goods to consume when the future has arrived. While admittedly presented in a very simplified manner, this is, in essence, how societies economically grow and become wealthier in terms of more desired goods to better satisfy the wants of their members.

Investment and the time structure of production

At the same time, all such investment processes take time and usually go through a variety of stages of production. We can imagine that from start to finish, such an investment process passes through five stages to be completed, with each stage, just for the sake of the example, requiring one month of time. Again, for simplification, we might assume that at each of the stages, the inputs (resources, labor, use of capital equipment) require expenditures of $100. We can further suppose that each stage is undertaken by a separate enterprise, which sells its partially completed version of the product to the next enterprise, until at the end of the fifth month, the product is in its finished form and ready for sale to an interested buyer.

Thus, the value added at each stage cumulatively comes to $500; if we presume that the entrepreneurial decisions at each stage had correctly anticipated the demand at the next stage, the final, finished product would sell for the $500 that has gone into its successful completion. If consumer demand for the product continues month after month, then each of these stages of production must be in process simultaneously through time. If this product is wanted for consumption in May, then the first of the five stages must be set in motion in January if it is to go through the remaining stages and be ready for sale at the end of May.

If the product is also wanted in June, then the same process must begin, again, in February, while the product to be sold in May is presently in stage two of this five-stage production process. If the product is also wanted in July, then stage one must start in March, while the May product is simultaneously in stage three and the June product is in stage two. In other words, each product planned to be brought to market must go through its own timeline

of production simultaneously with the others for the period-after-period desired output of the desired goods.

At each stage of production in the manufacture of every product, there is employed not only labor but some forms of capital equipment (machines, tools, etc.), which, like the oven in the earlier example, have to be eventually replaced due to wear and tear. In other investment sectors of the market, there must be in progress projects whose purposes are to plan and anticipate the demand by other enterprises needing replacement capital equipment. And each of these must be planned ahead so they will have gone through their respective stages of production and are ready for sale and installation so that other investment activities can continue in smooth coordination, with supplies tending to match future demands based on entrepreneurial anticipation of what future market conditions will be.

All of this overlapping and interdependent complexity of investment, production, supply, and demand are held together through the competitive price system. This price system facilitates the economic calculations concerning possible profits and losses that are estimated to be possible in changing circumstances and how best to produce what others want at the least cost. This is what enables a developed and extensive social system of division of labor to exist and coordinate the actions of multitudes of people, all of whom rely upon all those unknown others doing all the unknown things that generate the goods and services desired, and which results in the rising standards of living that so many of us simply take for granted with little or no thought about the social and economic institutional arrangements that make it possible.

Banking as the intermediary institution linking savings and investing

Key to all of this is a banking system that coordinates the willingness of savers to forgo current consumption so others may borrow what is saved (and the resources that savings represents) to undertake the time-consuming investment projects that enable capital and time-using production activities to begin. The rate of interest is not only the intertemporal price that brings saving and borrowing decisions into balance (like any other price that coordinates supply and demand). It also acts as a “break” on the time horizons of the investment projects undertaken, so the multi-stage production activities can be successfully completed (given the accuracy with which supply-side entrepreneurs effectively anticipate what consumers want and the prices they may be willing to pay in the future when goods in their finished forms are available for sale).

Of course, errors and misreading of particular future market conditions are not only possible but inescapable in a world in which all of us have less than perfect knowledge about the future. The problem that Mises became interested in were the frequent cycles of booms and busts, inflations followed by recessions or depressions. That is, disharmonies in the market process that impact not just one or few sectors of the economy at any particular time but economy-wide imbalances simultaneously. The answer, in his view, was to be found in the distinctive qualities of a money economy and modern banking systems.

Whenever a product is produced and sold in the market, its sale represents the seller’s demand for other things that he would like to buy. After all, in a system of division of labor, we each specialize in one line of activity and use what we produce as the means to pay for all the other things we desire that other individuals produce. Why else would anyone devote the time and trouble to produce an item and bring it to market?

But money turns what is one exchange under barter – a hat traded directly for a pair of shoes – into two transactions: the trading of one good for money and then the trading away of the money earned for some other good that is wanted. The hat I produce and sell need not be to the particular individual who has the shoes I want. The shoe manufacturer may have no need for my hats. So, instead, I sell my hat to someone in need of a hat in exchange for money, even though I may have no interest in buying the shirts or pants that the buyer of my hat specializes in offering on the market. Instead, having earned that sum of money, I use some of it to buy the pair of shoes I desire. Or as Mises expressed it in The Theory of Money and Credit:

Anybody who sells commodities and is paid by means of a cheque and then immediately uses either the cheque itself or the balance that it puts at his disposal to pay for commodities that he has purchased in another transaction, has by no means exchanged commodities directly for commodities. He has undertaken two independent acts of exchange, which are connected no more intimately than any other two transactions.

Saving and investing through the medium of money

The peculiarities of the modern banking system in facilitating the coordination of savings and investment, Mises argued, enables an understanding and analysis of how things may go wrong and bring about the business cycle, especially under central banking. Mises suggests a particular terminology to better appreciate the reason banking systems may be susceptible to economy-wide fluctuations. The starting point is when savers loan money directly to interested borrowers. What is lent is a sum of money that represents an amount of purchasing power in the market given the market value of the monetary unit.

That sum of purchasing power is transferred to the borrower, and it is used to demand and direct the use of scarce resources into the production of the particular goods the borrower wishes to invest in and use, rather than the particular goods that would have been demanded and supplied if the original income earner had chosen to spend it on current consumption rather than lending it for investment purposes to someone else. Thus, some of the scarce resources in society, instead of being used to supply, say, more dinners out at restaurants in the present, are freed up to be used to make that second oven, from the earlier example, that would enable an increase in bread production.

The trade-offs in society, as we saw earlier, involve not only whether to demand more shirts versus to demand more meals in the present, given the scarcity of means to serve the ends we desire; the trade-offs are also between shirts and meals in the present versus more goods of various types in the future by freeing up some of those resources from current uses.

Now, if banking had evolved in such a way that only the money saved by some was lent to others, the connection between foregoing more goods in the present in exchange for more goods in the future would have remained a fairly close fit. Even through that two-transaction exchange process of goods traded for money and then money traded for goods, there still would have been maintained a fairly close balanced relationship between the decisions of savers with those of borrowers to assure a coordination between consumption and investment activities consistent with the limited means at people’s disposal.

Banknotes and fractional reserve banking

One of the uses and conveniences of banking was that it made possible the use of banknotes issued by banks as claims to sums of commodity money — gold and silver — deposited with them as a “money substitute” for everyday transactions in lieu of directly using actual gold and silver left with the banks for safekeeping. If a bank had a good and reliable reputation of always “making good” when any holder of their banknotes demanded the withdrawal of the quantity of gold and silver the banknotes represented, that bank had greater leeway in issuing such money-substitute banknotes to those who wanted to borrow for some future-oriented investment plan that they might have in mind.

Suppose that the bank’s depositor clients were to deposit $10,000 in gold and silver into their accounts for which banknotes were issued as claims to the specie money. If these were literal savings accounts, and if the bank managers were confident that holders of those deposits would not make any significant or noticeable withdrawals from their accounts for, say, two years, then that bank could lend that $10,000 for two-year loans to those deemed “credit worthy,” with limited concern that the borrowed sum would not be repaid at the end of the two-year period, when it was anticipated that its savings depositors might make significant withdrawals. The savings-investment nexus would have been kept in a reasonably close demand and supply balance in the use of scarce resources across time.

But banks also discovered that on the basis of those deposits of $10,000 in gold and silver into their accounts, they could extend loans to borrowers significantly greater than that $10,000. Every day, there are bank customers making new deposits, while others are making withdrawals. Suppose the bank learns from experience that, on average, those who hold and use their banknotes for transactions in the marketplace only make, on net, withdrawals in gold or silver equal to 10 percent of whatever the bank’s total banknote liabilities may be. Thus, if depositors have $10,000 of actual gold and silver in the bank, depositors are unlikely to demand more than $1,000 in actual specie or commodity money during any particular period of time.

The bank could issue total loans, in the form of banknotes of, say, $20,000. If that bank’s business pattern were to hold, only 10 percent of those outstanding $20,000 bank-notes are likely to be turned in for redemption, or $2,000 of actual gold or silver withdrawn from the bank. Likewise, if the bank’s depositor and banknote users’ patterns were to remain the same, the bank could issue a maximum of $100,000 in banknotes, $10,000 of them representing the actual gold and silver of their claimants who deposited that actual specie or commodity money with it, plus $90,000 of

additional banknotes issued as loans to presumed credit-worthy borrowers.

Mises used the term commodity credit (or transfer credit) to represent the $10,000 of actual savings lent to some of those deemed to be credit-worthy borrowers; Mises called the amount of banknotes issued by such a bank in excess of that actual savings fiduciary media, or circulation credit (or created credit), that is, not backed by actual gold and silver deposited as savings by bank customers. Here, in Mises’s view, was the origin and the bases of the savings-investment relationship being thrown out of balance, resulting in an attempt to undertake investment projects, with their time structures of production, inconsistent with the actual available real savings to bring them to a profitably successful conclusion, or to be profitably maintained if completed before or after an economic crisis finally sets in.

***

When the English-language edition of Ludwig von Mises’s The Theory of Money and Credit was published 90 years ago, in 1934, the world was in the midst of the Great Depression. The American stock market crash in October 1929 soon snowballed into a severe economic downtown in 1930 and 1931 that reached its lowest point in terms of rising unemployment and falling industrial and agricultural output in 1932 and early 1933.

In Europe, the economic conditions were no better. Great Britain and France, for instance, were experiencing the same negative effects of falling outputs and rising joblessness, though the worst of it, in terms of these two indicators of economic “bad times,” was being experienced in Germany. Intensifying the global impact of the economic downturn was a return to trade protectionism in many of the leading economies, including the United States, along with foreign exchange controls that led, not surprisingly, to a dramatic fall in international trade and investment.

Government and the Great Depression

Why was the severity and depth of this economic depression the most serious in virtually anyone’s living memory? In Mises’s view, it was due to the degree to which governments almost everywhere were introducing policies that hindered and prevented the market economy from readjusting and rebalancing following what had turned out to be the false prosperity of the 1920s. Not that all that had happened in the 1920s was unsustainable or lost. Technological innovations, cost-

efficiencies, improvements in organization and management of industry and manufacturing, had represented real improvements in the standards and qualities of life for many around the world, especially in the United States.

But overlaying these impressive improvements in production potentials had been monetary policies followed in the United States and in Europe that had brought about mismatches and imbalances between savings and investment that had set the stage for an inescapable period of correction, due to unsustainable price and wage relationships and resource and capital uses, if there was to be a return to longer term growth and stability of the market economies in these countries.

There had been economic booms and busts, inflations and depressions in the past. These earlier downturns, however, had rarely been anywhere nearly as severe and disruptive as was being experienced in the 1930s. In the past, governments, for the most part, had kept a fairly “hands off” policy approach, allowing financial and investment and consumer markets to adjust and find their new coordinating price and wage patterns and resource and capital uses across sectors of the economy to return to full employment and output potentials.

The gold standard and growing government intervention

However, in the 1930s, governments did the opposite. The British government had ended the gold standard as the basis of the country’s monetary system in September 1931. Following the inauguration of Franklin D. Roosevelt in the United States in March 1933, the United States was taken off the gold standard in June of that year with the command that Americans had to turn in their gold coins and bullion in exchange for Federal Reserve paper money under threat of arrest, confiscation, and imprisonment.

First under Republican President Herbert Hoover and then under FDR’s New Deal programs, the U.S. government ran large budget deficits, raised taxes on business, undertook sizable public works projects, and interfered with market-based adjustments of wages and prices to restore balance between supplies and demands. Indeed, with the coming of the New Deal, Roosevelt imposed a fascist-style system of economic planning over industry and agriculture that for all intents and purposes did away with the American market economy. Only a series of Supreme Court decisions in 1935 and 1936 that declared some of the major New Deal programs as unconstitutional saved America from the possibility of a permanent command economy.

In the 1920s, Germany had a weak post–World War I democratic government, known as the Weimar Republic. In 1931 and 1932, the three largest political parties represented in the German parliament were the Social Democrats, the National Socialists (Nazis), and the Communists. In January 1933, Adolf Hitler was appointed Chancellor (prime minister), and within months, the Nazis were rapidly transforming the country into a totalitarian dictatorship, with government-directed spending and investment as the keystones of the National Socialist economic program. The Nazis formally introduced four-year central planning in 1936.

In neighboring Austria, where Mises was living and working as a senior economic analyst for the Vienna Chamber of Commerce, a brief civil war broke out in February 1934 between the fascist-oriented government and the armed forces of the Social Democratic Party, which ended with the defeat of the Austrian socialists. Soon after, a new constitution was instituted that officially established an authoritarian political system and a corporativist economy. In October 1934, Mises left Austria and took up his first full-time professorship at the Graduate Institute of International Studies in Geneva, Switzerland. This enabled him to escape both from living under the fascist dictatorship in his home country and the rising tide of aggressive anti-Semitism in both Nazi Germany and in the Republic of Austria that became violent and deadly in Mises’s homeland after Hitler entered Vienna in March 1938 and Austria was annexed into the German Third Reich. (See my article “Celebrating the Arrival of Ludwig von Mises in America,” Future of Freedom, August 2020.)

Mises on the causes of the Great Depression

In February 1931, Mises delivered a lecture on “The Causes of the Economic Crisis,” which was soon afterwards published in German in an expanded version. The countries of Europe and the United States were caught in this Great Depression precisely because governments had failed to allow market-based readjustments and rebalancing to restore production and employment.

Instead, governments did their utmost to maintain prices and wages at nonmarket levels through various forms of intervention and regulation. Tariffs protected uncompetitive domestic producers from foreign rivals; trade unions were privileged with unofficial power to shut down businesses and use violence to prevent nonunion workers from filling the jobs of union workers on strike as part of the attempt to impose higher-than-market wages; unemployment insurance was used to reduce the pressure on unions from the jobless; taxes on private enterprise reduced investment and threatened the consumption of capital; and government deficit spending was used to “create” jobs bound to be found to be mostly wasteful and unnecessary. From this Mises concluded:

If everything possible is done to prevent the market from fulfilling its function of bringing supply and demand into balance, it should come as no surprise that a serious disproportionality between supply and demand persists, that commodities remain unsold, factories stand idle, many millions are unemployed, destitution and misery are growing and that finally, in the wake of all these, destructive radicalism is rampant in politics.… With the economic crisis, the breakdown of interventionist economic policy — the policy being followed today by all governments, irrespective of whether they are responsible to parliaments or ruled opening as dictatorships — becomes apparent.

The corrupting influence of the interventionist state

The corrosive effect such interventionist policies had on the functioning of the market and the perverse antisocial incentives it fostered in the private sector was explained by Mises a year later, in 1932, in an essay entitled, “The Myth of the Failure of Capitalism”:

In the interventionist state it is no longer of crucial importance for the success of an enterprise that the business should be managed in a way that it satisfies the demands of consumers in the best and least costly manner. It is far more important that one has “good relations” with the political authorities so that the interventions work to the advantage and not the disadvantage of the enterprise. A few marks more tariff protection for the products of the enterprise and a few marks less for the raw materials used in the manufacturing process can be of far more benefit to the enterprise than the greatest care in managing the business. No matter how well an enterprise may be managed, it will fail if it does not know how to protect its interests in the drawing up of the customs rates, and in the negotiations before the arbitration boards, and with cartel authorities. To have “connections” becomes more important than to produce well and cheaply.

So, the leadership positions within enterprises are no longer achieved by men who understand how to organize companies and to direct production in the way the market situation demands, but by men who are well thought of “above” and “below,” men who understand how to get along with the press and all the political parties, especially with the radicals, so that they and their company give no offense. It is that class of general directors that negotiate far more with state functionaries and party leaders than with those from whom they buy and to whom they sell.

Since it is a question of obtaining political favors for these enterprises, the directors must repay the politicians with favors. In recent years, there have been relatively few large enterprises that have not had to spend very considerable sums … [on] campaign contributions, public welfare organizations and the like…. The crisis from which the world is suffering today is the crisis of interventionism and of national and municipal socialism, in short, it is the crisis of anti-capitalist policies.

The German economic environment was one in which a symbiotic relationship closely connected those in politics and the bureaucracy with special-interest groups desiring favors and privileges at others’ expense. It is not too surprising that a year later, in 1933, the corrupt and corrupting interventionist state transitioned easily into the National Socialist command and control economy — and that in Mises’s own country of Austria, authoritarian fascism and the planned economy followed a year later in 1934.

Mises’s theory of the business cycle

However, even if a growing spiderweb of government interventionist policies explains how and why the Great Depression of the 1930s became so deep and prolonged, there still was the question of how and why the depression had occurred at all. In other words, what were the monetary and banking policies that preceded the Great Depression that made an economic downturn inevitable. Mises had first presented what later became known as the Austrian theory of the business cycle in The Theory of Money and Credit, and then in his monograph, Monetary Stabilization and Cyclical Policy (1928).

Mises’s theory of money, banking, and the business cycle was a synthesis of Carl Menger’s theory of money, Eugen von Böhm-Bawerk’s theory of capital, and Knut Wicksell’s theory of interest rates and prices. As we saw, earlier, building on Menger, Mises developed an analysis of the non-neutrality of money, that is, how changes in the money supply works its way through the market in temporal-sequential patterns that influence the structure of relative prices and wages and the allocations of resources and capital among sectors of the economy.

Mises adapted Böhm-Bawerk’s theory of a time structure of investment and production, focusing on the price-coordinating market processes by which resources and labor are combined in the required stages of production to both produce capital goods and with capital to manufacture desired finished goods wanted by consumers. Each of these of stages of production must be successfully coordinated with the others. The “length” of the respective time-structures must also be consistent with the amount of overall savings in the economy so the needed and necessary resources, labor, and capital goods may be available to complete and maintain the complex processes of production through period after period of time.

As we also saw, the market-generated rate of interest assures that investments undertaken are able to be maintained and kept within the bounds of the savings set aside by income-earners. In a world of scarcity, the uses for the resources of any society are in competition between different applications of them both in the present and between the present and time horizons of the future. More of them used in one direction means that there is less available to utilize in alternative ways.

Knut Wicksell on interest rates and the inflationary process

The Swedish economist Knut Wicksell (1851–1926) argued in Interest and Prices (1898) that if goods in the present directly traded for goods in the future, that is, as in barter transactions, the intertemporal competitively determined price between goods in the present and the future would tend to assure that investment was kept in balance with savings. The intertemporal price of present goods for future goods is the equilibrium “natural rate of interest.” However, in actual markets, all trades, including those across time, are undertaken through the medium of money. Money in the present (and the purchasing power over various goods that sum of money represents) is traded for a sum of money in the future (and the purchasing power over various goods that sum of money is expected to represent).

If the money rate of interest coincides with the hypothetical equilibrium “natural” rate of interest, then savings and investment are kept in coordinated balance even in a money-using economy. The problem, Wicksell pointed out, is that the quantity of money offered through the banking system for investment purposes may exceed the quantity of money that income-earners had originally deposited in the banking system as desired savings. Or banks could lend less in the form of money loans than had had been deposited with them as money savings. Thus, there could be either total money investments undertaken greater than money savings, or more money savings than money loans issued within the banking system. Thus, total investments greater than available savings, or total investments less than available savings.

Banks might try to extend money loans greater than deposited savings by setting the interest rate below the natural rate through the creation of bank notes or increased checking deposits for those additional borrowers to spend. But since scarcity continues to limit the real total of economic activities that can be undertaken, the increased quantity of money only ends up generating a cumulative rise in prices (price inflation) for as long as the money rate of interest is kept below the natural rate. Similarly, if the money rate of interest were to be set above the natural rate, total money loans undertaken would be less than available money savings, with part of the total quantity of money in the economy taken out of circulation, resulting in a cumulative decline in prices (price deflation) for as long as the money rate of interest was kept higher than natural rate.

Free banking and the limits on inflationary currencies

This was the backdrop to Mises’s theory of the business cycle. As he developed the theory through the 1920s and 1930s, Mises argued that if there prevailed private competitive free banking, there would be market-based checks and balances preventing such imbalances between savings and investment from occurring to any significant degree. If any one or number of banks decided to increase their respective quantity of bank notes or checking accounts by lowering the money rate of interest at which they were extending loans to potential borrowers, the sums borrowed would soon be spent by those borrowers on various goods and services they wanted to buy.

Those receiving the banknotes issued in this way by, say, the Adam Smith Bank would deposit them in their own banks, say, the Thomas Malthus Bank and the David Ricardo Bank. The Thomas Malthus and David Ricardo Banks, receiving deposits of the banknotes of Adam Smith Bank from their bank customers, would trade them in through what is called the “clearing house,” demanding the gold or silver that those banknotes represent from the bank that issued them. Banks that have overissued their banknotes relative to other banks will experience a net outflow of their gold and silver deposit reserves. If they continue their own monetary expansion in this manner, they threaten, over time, to face insolvency or even bankruptcy as the total number of banknotes claimed against them threaten a loss of all their gold and silver reserves.

At the same time, if their own depositors become concerned about the bank’s solvency, that bank would risk facing a bank run, that is, many of their depositors all demanding their gold and silver money more or less simultaneously. Thus, in their own self-interest, under the pressures of the clearing house process and maintaining the confidence of their own depositor customers, private banks, under a competitive free-banking system, would have incentives to resist excessive creation of fiduciary media (banknotes and deposits not fully covered by gold and silver reserves).

Unjustifiable creations of bank-notes and checking deposits (that is, in excess of actual gold and silver money deposited with that financial institution) would be kept in narrow bounds under private competitive banking. Looking over the market as a whole, therefore, investment would be kept within the scarcity constraints of actual savings set aside by income-earners for such purposes. As Mises explained it in Monetary Stabilization and Cyclical Policy, in a free banking environment, there might still be fiduciary media issued by banks:

However, banks would have to be especially cautious because of the sensitivity to loss of reputation of their fiduciary media, which no one would be forced to accept. In the course of time, the inhabitants of capitalistic countries would learn to differentiate between good and bad banks…. The management of solvent and highly respected banks, the only banks whose fiduciary media would enjoy the general confidence essential for money-substitute quality, would have learned from past experiences.

The cautious policy of restraint on the part of respected and well-established banks would compel the more irresponsible managers of other banks to follow suit.… For the expansion of circulation credit can never be the act of one individual bank alone, nor even a group of individual banks…. If several banks of issue, each enjoying equal rights, existed side by side, and if some of them sought to expand the volume of circulation credit while others did not alter their conduct, then at every bank clearing, demand balances would regularly appear in favor of the conservative banks. As a result of the presentation of notes for redemption and withdrawal of their cash balances, the expanding banks would very quickly be compelled once more to limit the scale of their emissions…. It may be that a final solution of the problem of [unjustifiable monetary expansion] can be arrived at only through the establishment of completely free banking.

Central banks and monetary expansion

However, this was not how the banking systems had developed in Europe or North America. It is true that in the nineteenth century, after earlier experiences with paper-money inflations caused by governments or their central banks, new rules were established under which many of the leading central banks managed their systems according to the rules of the gold standard. But these remained, nonetheless, monopoly monetary systems controlled and managed by government central banks.

Governments and their central banks would periodically oversee undue expansions of fiduciary media and the artificial lowering of money interest rates through the banking systems under their control. This would set the stage for the types of price inflationary booms and price deflationary busts that Wicksell had outlined in Interest and Prices. This was only exacerbated in the twentieth century when central banks were taken off the gold standard by their respective governments, with no longer the check and fear of losing gold reserves underlying a country’s monetary system.

The additional aspect to the Wicksellian process that Mises developed was a focus on the non-neutral manner in which monetary and credit expansions through the banking system distorted the relative price structure and the allocations and use of capital and labor across sectors of the market. Such an artificial lowering of the money rate of interest below the “natural” rate results in the newly created money and credit first passing into the hands of borrowers who utilize the new money at their disposal to undertake investment projects for which the amounts of real resources to complete and sustain them will be found to be insufficient in the longer-run.

They place orders with the suppliers of capital equipment and construction enterprises to start or expand investment projects, and they hire workers to assist in these endeavors. The resources, labor and capital for these undertakings are drawn from more immediate consumption goods production through the offering of higher prices and wages made possible by the expansion of the money and credit by which those loans have been extended to them.

If these factors of production had been redirected into the more time-consuming investment sectors due to actual increases in people’s savings preferences (and therefore an implied decrease in preferences for consumer goods), the increased demands for inputs in investment goods production would have been counter-balanced by a decrease in the demands for consumer goods production. The changes in relative prices and wages, and reallocations of inputs from some areas of the market to others, would have brought about the needed recoordinated equilibrium. In time, the greater savings and completed investment activities would bring forth the improved and increased supplies of consumer goods that would be the future “reward” for foregone consumption in the more immediate present.

Monetary expansion and misallocation of resources

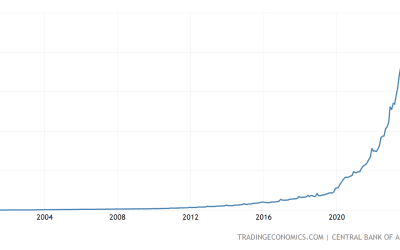

But this is not the case. Instead, the central bank monetary authority increases the lending reserves of the banks (in the case of the Federal Reserve of the United States, most frequently by purchasing U.S. government securities that the federal government has issued to cover deficit spending), which expands their ability to extend additional investment loans to interested borrowers in the private sector at lower rates of interest made possible by the increase in loanable funds in the banking system.

Borrowers compete away the resources, labor, and capital to initiate their investment projects by offering higher factor prices from their current employments in the consumer-goods sectors. But there are no corresponding decreases in consumer goods prices or the factor prices in these parts of the market since there has been no decrease in consumer demands. Those drawn into the investment goods sectors may be presumed to have the same consumption-savings preferences they had before their new employments. They use their higher money incomes to demand the same proportions of consumer goods as before. Therefore, prices in the consumer goods and complementary factor markets rise, with those still employed in consumer-goods sectors experiencing also increases in their money wages and factor prices. But these higher prices and wages in the consumer goods parts of the economy act as a “pull” to attract workers and resources away from the investment goods markets and back to consumer-goods production.

If the monetary expansion, with the resulting lower rates of interest and greater investment borrowing, was a “one-off” act by the central bank, relative prices and wages and resource, labor, and capital uses would reestablish themselves after a short period of time in the pattern reflecting income earners’ underlying preferences for consumption and savings. But historically, the central-banking authorities, once they have initiated an expansionary monetary and lower interest-rate policy, continue it period after period, with new injections of lendable funds into the banking system and with interest rates pressed down below where the market would set them in a noninflationary environment.

Prices continue to rise following in the temporal sequence in which the money is introduced, spent first on investment activities, followed by rising factor incomes, and then by increased money demand for consumer and other goods and services. A tug-of-war occurs with investment goods producers and consumer goods producers competing against each other in the attempt to pull the factors of production in one direction and then another.

If the “twisted” production house of cards is to be maintained indefinitely, the central-bank authority finds it necessary to accelerate the rate of monetary expansion so in the temporal sequence of rising prices, the “injections” are great enough to keep the relative prices of production goods ahead of the relative prices of consumer goods. Otherwise, if consumer goods prices completely catch up with or start to rise at a faster rate than production good prices, the monetary-induced investment patterns will be found to be unsustainable, and the recession phase of the business cycle will set it. And, indeed, unless the monetary authority allows the inflation to get completely out of control, with a resulting hyperinflation of economic chaos, the inflation must be ended or significantly slowed down, at which point the recession can no longer be avoided.

Stabilizing the price level destabilized the market process

In the 1920s, the Federal Reserve had attempted to maintain a stabilized “price level” in an economy of growing output, productivity increases, and cost efficiencies that would have otherwise resulted in falling consumer prices to the betterment of the buying public now able to purchase more and better goods at lower prices. Instead, the Federal Reserve increased the money supply in an attempt to counteract this benign price deflation. As a result, it in fact created a hidden price inflation by keeping prices in general higher than they otherwise would have been if the money supply had not been increased.

Thus, beneath the surface of a relatively stable “price level,” central bank monetary policy had set in motion a distortion and mismatch between savings and investment that inevitably had to end in an economic downturn. But an economic downturn became the Great Depression only because government interventions of sundry sorts had prevented the market process from bringing about a healthy rebalancing of supplies and demands and prices that would have brought back full employment without the economic disaster of the 1930s.

This article was originally published in the March-May 2024 edition of Future of Freedom.