A new wealth report from the Federal Reserve highlights the theme of my last post: The Fed’s Quantitative Easing policies are a massive giveaway to the rich.

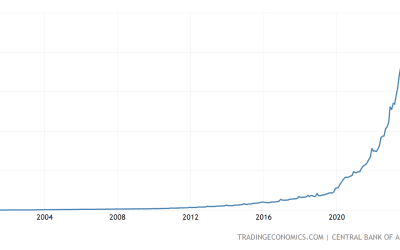

The graph depicts the percentage of all wealth owned by people in different wealth strata since 1990.

The lower blue line shows that the top 1% now own 29% of total wealth, up from 23% when the Fed introduced Quantitative Easing (QE) in 2010. At the same time, the wealth owned by folks in the 50th to 90th percentile (green line) has shrunk from 33% to 29%.

Notice how the lines have converged since QE began in 2010. And note the even sharper convergence since March 2020, coinciding with the Fed’s massive pandemic stimulus (nearly $2 Trillion).

The top 10% (red line) held their own at a steady 36%. If you’re in this group, perhaps you didn’t notice much change in your wealth – or maybe just a gradual change – since QE started over ten years ago.

These data illustrate two sides of the Fed’s QE coin:

- Heads – the unrelenting erosion of financial security among the middle class and mid-tier earners, and

- Tails – the accelerating wealth of the top 1%, i.e., the rich.

In a free-market economy, unimpaired by government force, there is nothing unjust about wealth disparity per se. On the contrary, in a market economy, most wealth differences arise from the voluntary choices of market participants. These choices result in the specialization of production – a process economists call the “division of labor.”

Specialization allows each economic participant to earn a living by being very good at providing just one thing that many other people need. Tailor, banker, miner, scribe – all provide a product or service valued by many others. Each participant chooses their specialty, subject to their ability.

Specialization creates the “cooperative wisdom” of a free market by multiplying knowledge far beyond what any genius or committee could ever hold in mind. Free economic exchange, powered by specialized production and market wisdom, is the foundation of economic progress and thus the source of virtually all wealth.

Specialization requires that people choose their values. Some people like to work hard, while others value more leisure time. Most people balance their values to include not only monetary wealth but other values as well. We all know college professors, writers, adventurers, RV nomads, and weekend golfers – all capable people who, no doubt, could acquire more monetary wealth if they wanted to invest the time and effort required to get it.

All these folks make their own choices. In an unhampered market, their individual decisions will provide them with differing amounts of wealth.

By contrast, the extraordinary shift of wealth depicted on the above graph did not come from the choices of free individuals. As detailed in my last two posts (here and here), the Federal Reserve has sabotaged rational economic choice, first by smashing interest rates, thus penalizing thrifty savers; and second by inflating asset prices, thus enriching the wealthy.

The Fed and its legal enabler, the US Congress, are fully responsible for this unfair wealth transfer. The Fed denies it, but their crime is now well understood by politicians, Wall Street, and even some on Main Street.

The politicians’ reaction to this injustice will be a retributive response to take back from the investor class what the political class will say they have stolen. The public will buy this accusation because everyone envies the rich guy.

However, neither the Fed nor Congress will give anything back to the middle class because it’s impossible to identify the individuals who deserve compensation. Instead, it will merely be an exercise in punishing the rich by taxation.